Residential flexibility has become crucial in addressing the increasingly complex challenges of balancing and optimizing the electricity network. Working closely with various Group entities, EDF Pulse Ventures has conducted a comprehensive analysis of the UK market to identify innovative start-ups that could unlock future opportunities for the Group in the residential flexibility sector.

What is flexibility?

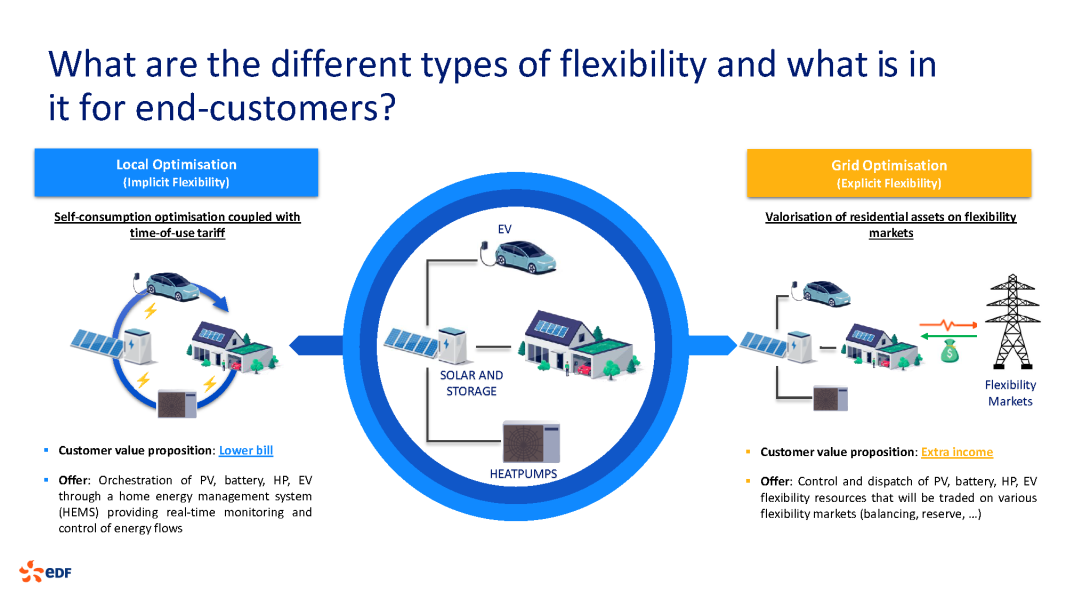

In the electricity ecosystem, flexibility refers to the dynamic capability of both producers and consumers to modulate their electricity generation or consumption in real-time, ensuring a critical balance between supply and demand across the network. This flexibility can be delivered through a diverse spectrum of assets—ranging from massive grid-scale power plants generating several hundred megawatts, to smaller behind-the-meter equipment like heat pumps and electric vehicle charging stations, which typically draw between 1 and 10 kilowatts.

"Demand Side Flexibility" encompasses the strategic adaptations consumers can implement across their energy consumption, local generation, and storage capabilities, responding dynamically to grid operator price signals or direct operational instructions. This flexible approach to energy management can be leveraged by a broad spectrum of stakeholders, ranging from homeowners to large commercial and industrial enterprises.

"Residential flexibility" zeroes in on the unique potential of the residential sector to contribute to energy management, particularly through strategic assets like electric vehicle charging stations, smart heating systems, and home battery storage. Propelled by the accelerating electrification of energy consumption, the rapid expansion of renewable energy technologies, and the increasing digitalization of household devices, residential flexibility has emerged as a critical strategic frontier—offering unprecedented capabilities to track and optimize energy usage with near-instantaneous precision.

The growing interest in residential flexibility is reshaping the UK energy market, as demonstrated by the "Big Six" energy suppliers' strategic approach. EDF UK, among these key players, is actively seeking to encompass the entire value chain through strategic partnerships and targeted acquisitions. Against this backdrop, new commercial offerings have emerged, based on the promise of value creation for consumers and suppliers:

- Reduction in electricity bills for consumers through intelligent management of consumption

- Generating revenue for consumers and suppliers via monetizing system services to the power grid

Projections suggest the UK flexibility market is poised for exponential growth, with forecasts indicating a leap from 580 million pounds in 2024 to an impressive 2 billion pounds by 2035.

The economic and operational challenges of the flexibility market

The residential flexibility services market is encountering substantial barriers that are impeding its rapid evolution. Compared to established system services, this nascent market remains constrained by fundamental structural limitations. Electricity trading platforms, for instance, typically mandate a minimum 1 MW threshold for flexibility units, which systematically marginalizes smaller residential energy assets. As a result, these more modest resources are frequently overlooked in favor of large-scale traditional power generation units.

Furthermore, the market's complexity is exacerbated by an increasingly fragmented partnership landscape. As value streams become dispersed across a growing network of stakeholders, the potential economic value becomes progressively diluted. This intricate web of intermediaries effectively undermines the overall financial potential of residential flexibility services.

EDF UK and flexibility

The development of innovative flexibility solutions stands as a critical strategic imperative for the Group, representing a cornerstone of the ambitious "Ambitions 2035 Corporate" initiative. In the United Kingdom, the Wholesale Market Services team (WMS) has established itself as a pioneering commercial battery optimizer, currently managing an impressive 2 GW of energy volumes.

WMS has been actively exploring the market's receptiveness to residential flexibility propositions through several innovative offerings:

-

Beat the Peak

An ingenious program that incentivizes consumers to shift their energy consumption away from peak hours, rewarding them with complimentary electricity during weekend periods

-

Heatsmart

A sophisticated solution designed to optimize energy consumption for households equipped with heat pumps

-

Opticharge

A smart charging platform enabling electric vehicle owners to strategically schedule their charging cycles based on the following day's wholesale electricity prices

Concurrently, WMS is collaborating closely with Dreev to advance residential battery optimization and transition to a "Virtual Trading Party" (VTP) status. This strategic move will enable EDF UK to monetize its customers' flexibility resources directly on the wholesale energy market.

Key Figures

| The Group estimates that the need for flexibility in Europe will double or triple by 2050 |

|---|

| EDF's objective is to develop 27 GW of additional flexibility worldwide by 2035 |

Start-ups innovating in flexibility

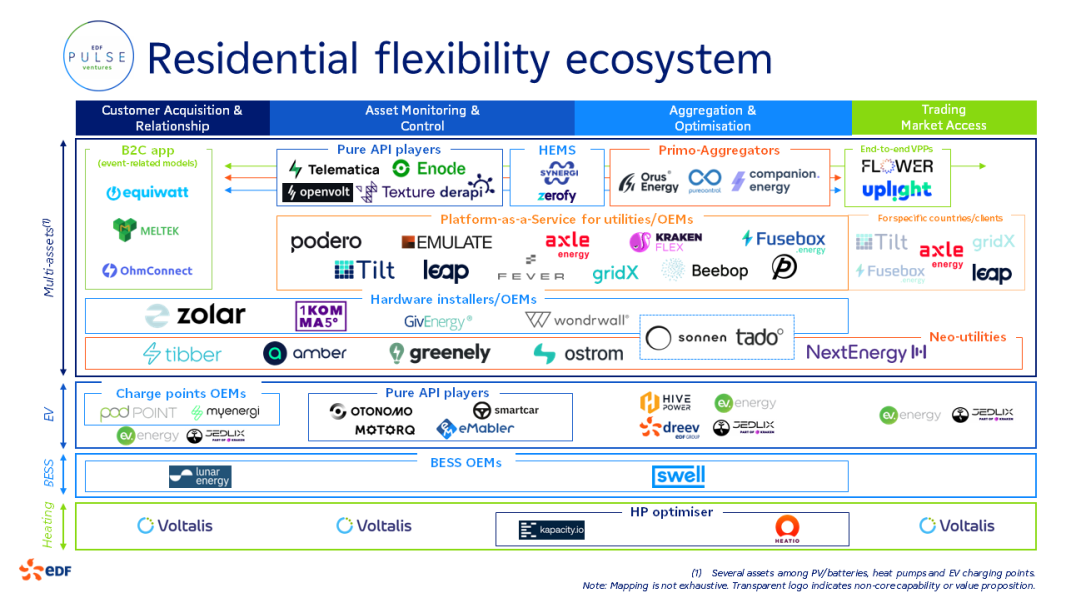

As part of this deep dive, EDF Pulse Ventures has identified numerous start-ups focused on residential flexibility in the UK market. These start-ups are categorized into four positions within the value chain, with EDF Pulse Ventures particularly concentrating on the first three:

- Customer Acquisition & Relationship

- Asset Monitoring & Control

- Aggregation & Optimizatio

- Trading Market Access

These players operate across several segments, including photovoltaic panels, battery storage systems, heat pumps, and electric vehicle charging points.